June 12, 2008

Tall Order In ‘Tall City:’

How Midland Stopped Worrying and Learned to Love the Corporate Dole

Two years after the state pledged $20 million to the nation’s biggest sub-prime lender to create 7,500 jobs in Texas, the Midland Development Corporation (MDC) offered Countrywide Financial Corp. another $2.5 million in tax dollars to open a shop in Midland. Local media trumpeted the news as a coup for House Speaker Tom Craddick, the Midland native who controls one of three votes over Texas Enterprise Fund disbursements, and as a vindication of MDC’s anemic record of diversifying Midland’s oil-based economy.1 “Now that the MDC has hit a home run with its [Countrywide] announcement,” the Midland Reporter-Telegram reported in 2006, “its [batting] average might not be up there with the Babe Ruths and Ty Cobbs of the major economic development leagues. But it’s more than respectable.” 2

After Countrywide occupied the former Midland headquarters of the Federal Deposit Insurance Corp. (FDIC) in December 2006, the mortgage giant’s Midland office effused Shakespearean portent. Countrywide and local development officials said in August 2007 that the implosion of the national housing bubble—which Countrywide had done so much to inflate—should not derail the company’s local subsidy deal.3 Three weeks later Countrywide axed 20 percent of its national workforce and closed its office in Midland’s old FDIC building, a shrine to Midland’s boom-bust cycles.4 |

|

FDIC paratroopers stormed Midland in 1983, descending on wreckage of what was then the second-largest U.S. commercial bank failure. In becoming Texas’ largest independent bank, the $1.8 billion First National Bank of Midland (FNBM) had weathered Midland’s boom-bust economy for decades.5 Blinded by soaring oil prices, however, it made a big bet on rising crude prices in 1980. Going beyond established producing wells, FNBM moved into high-risk, exploratory drilling ventures.6 Quickly doubling its paper assets, FNBM—which had helped inspire Midland’s “Tall City” nickname—planned a new skyscraper that would soar twice as high as its existing 20-story headquarters. But FNBM’s house of cards collapsed when oil prices plummeted in 1982.7 Even $664 million in emergency federal loans failed to keep FNBM afloat. A year after FNBM failed, the FDIC had more than 300 employees in Midland, liquidating the wreckage for pennies on the dollar.8

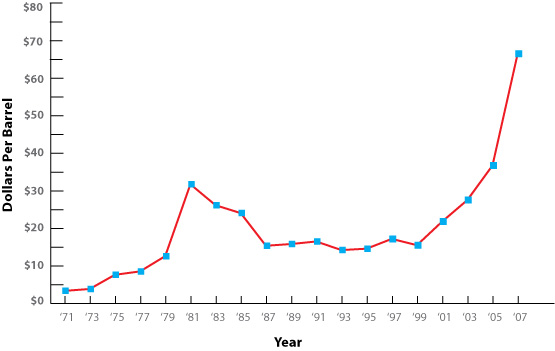

The FNBM credit bubble and Midland’s boom-bust economy may explain the otherwise-puzzling behavior of Midland voters. FDIC bailouts notwithstanding, many Midlanders view themselves as entrepreneurs who thrive on wits, hard work and God’s grace. Midlanders are some of the planet’s most conservative, free-enterprising and tax-loathing voters. Twice previously they defeated city plans to impose a special tax to promote “new and expanded business enterprises” in the area.9 Then, in 2001, 59 percent of Midland voters swallowed concerns about government economic planning and authorized a new 0.25 percent sales tax to fund what became the Midland Development Corporation (now headed by former FNBM Vice President Doug Henson). Noting that the number of Midlanders who ranked among the 400 richest Americans had fallen from eight to zero, Forbes Magazine reported at the time that “the challenge for this conservative city, which has always opposed taxes or government intervention of any sort, is how to inspire new businesses to generate jobs and diversification.” 10 Ironically, five days after Midlanders approved a tax to diversify their fossil-fuel economy, 9/11 terrorist attacks unleashed global events that have helped push oil prices to record highs.

Texas’ 2002 state elections also advanced corporate welfare in Midland. Texas voters elected a Republican majority in the Texas House that year, which helped make Tom Craddick speaker in 2003. That same session, the legislature approved Governor Rick Perry’s proposal to create the Texas Enterprise Fund (TEF).11 The three state officials who control this state development fund—Governor Perry, Lieutenant Governor David Dewhurst and Speaker Craddick—awarded $465,000 in TEF funds to Midland-based TRACE Engines (see below). This trio also approved two large awards from the state’s Emerging Technology Fund that benefit the Permian Basin.12 State handouts in the speaker’s backyard are significant because—by one measure—no Texas city has less need for public assistance. Midland enjoyed the state’s lowest unemployment rate for the past four years (2.9 percent in 2007).13 Yet it has received more TEF aid than the McAllen area, which led the state in unemployment last year (7.9 percent). Apart from the Permian Basin’s sparsely populated Loving County, Midland enjoys Texas’ highest per capita income.14

The Midland Business Cycle

(AKA Average Price of U.S. Crude Oil )

Source: "Average Annual U.S. Crude Oil Wellhead Acquisition Price by First Purchasers," U.S. Energy Information Administration.

Despite the expenditure of millions of tax dollars, Midland’s economy continues to be utterly dependent upon its now-booming oil economy. In a talk to the Permian Basin Petroleum Association in February 2008, an official from the El Paso branch of the Federal Reserve Bank of Dallas presented a graph showing how Midland’s unemployment rate mirrors its oil-rig count.

The Midland Development Corp’s Biggest Development Awards15

| Recipient | Business | MDC Award |

Award Date |

Paid To Date |

Job Target |

New To Area? |

| D. Baldwin Painting | Aircraft painting | $22.8 M. |

Canceled |

$0 |

200 |

Yes |

| Countrywide Fin’l | Mortgage loans | $2.5 M. |

12/06 |

$700,000* |

500 |

Yes |

| Entrada Building A | MDC spec building | $2.5 M. |

5/06 |

$2.5 M. |

NA |

Yes |

| HT3R Reactor | Nuclear reactor | $500,000 |

2/06 |

$500,000 |

NA |

Yes |

| Semperian, Inc. | Loan servicing | $439,500 |

4/02 |

$439,500 |

490 |

Yes |

| Trace Engines | Aircraft engines | $400,000 |

12/06 |

$400,000 |

114 |

Yes |

| Nat’l Gas Services | Gas compression | $275,000 |

2/08 |

$0 |

49 |

No |

| Reliant Holdings | CO2 processing | $250,000 |

7/07 |

$0 |

55 |

No |

| Sentry Pumping | Oil equipment | $250,000 |

11/07 |

$150,000 |

50 |

Yes |

| BCCK Engineering | Natural gas refining | $225,000 |

7/07 |

$180,000 |

15 |

No |

| W. Power & Light | Electricity retailer | $210,000 |

11/04 |

$70,000* |

23 |

Yes |

| FutureGen | Coal gasification | $200,000 |

FY 2007 |

$0 |

NA |

Yes |

Source: Midland Development Corp. and media reports.

MDC’s two biggest-ticket deals—Countrywide Financial and a $2.5 million speculative commercial building that the agency built—have been disasters. In unveiling the Countrywide deal, MDC officials claimed that they developed “new business models” during their two-year courtship of the lender. “Rather than demand Countrywide commit to a standard center with 2,300 employees,” the Midland Reporter-Telegram explained, “Midland Development Corp. officials said they were flexible and offered a framework requiring only 200-500 jobs for the firm to qualify for its full $2.5 million in incentives.” 16 Apparently, MDC’s novel approach amounted to making timid demands of the private company to which it offered millions of tax dollars. If you throw money at a corporation, it has a fiduciary duty to bend over and pick it up.

![]()

MDC calls its other seven-figure development deal the Entrada Business Park, invoking the Spanish word for “entrance.” Speculating that businesses would find a use for it once built, MDC spent more than $2.5 million to erect the cavernous, 40,000-square-foot industrial building that it hopefully named “Entrada Building A.” Commercial building on spec is as risky as it gets in real estate—even in a near-full-employment economy. Two years after MDC completed this project in May 2006, the agency has yet to unload it. The $1.75 million asking price advertised on MDC’s website would appear to yield a taxpayer loss of some $750,000.17 The agency offers no apologies for Entrada. A year after completing this empty shell, MDC bought 127 acres of city land for an industrial area to target companies “interested in more land and bigger sites.”18

|

Mike Hatley serves as MDC’s development specialist under a contract with the Midland Chamber or Commerce. Hatley said in an interview that Entrada’s ultimate sales price—and the project’s ultimate success or failure—hinge upon how well any future buyer meshes with local development needs. “If the right project came along, we might write that [the asking price] down further,” he said. While the Midland Reporter-Telegram has been a dependable MDC booster, skeptics congregate on the local blog Jessica’s Well whenever the MDC announces a new handout of city money.19 |

Entrada borrows its name from a more grandiose diversification scheme that the Midland-Odessa Transportation Alliance (MOTRAN) launched when oil prices were soft in the mid-1990s. With development officials in Chihuahua, Mexico, MOTRAN, which now receives $65,000 a year in MDC funding, proposed building La Entrada al Pacífico, an 800-mile NAFTA superhighway to Mexico’s Pacific port of Topolobampo. Even advocates say this scheme to bypass ports in Seattle and Long Beach will take decades given huge infrastructure obstacles in Mexico, competing plans in Baja California and opposition by residents in the Big-Bend area. Charles Perry, MOTRAN’s septuagenarian founder, told the Texas Observer that the 40-year project will not “happen in my lifetime.” 20 |

|

MDC unveiled tentative plans in April 2008 for its biggest deal to date—one that would net a strikingly small fish. MDC proposed spending $23 million to construct and renovate a total of three hangars at the Midland airport to lease to Dean Baldwin Painting, 21 an aircraft-painting company that the governor’s office referred to MDC. When word of the deal broke, an anonymous blogger quickly reported on Jessica’s Well that the company’s New Mexico plant had been a big recipient of government aid before it fell behind in tax, rent and loan payments to government entities there. Immigration agents with U.S. Customs and Enforcement (ICE) also busted the plant in 2006, prompting this federal agency to issue an eerie media release entitled: “ICE arrests 15 aliens in Roswell.” 22 Some members of the Midland City Council—which quickly quashed the Dean Baldwin deal—said the agency failed to inform them about the company's problems.23 What is perhaps most striking about the Dean Baldwin deal, however, is that the company grossed $12.7 million in 2007.24 Yet MDC proposed spending twice this amount on hangars for the company.

|

|

To be sure, not all MDC development projects have been flops. In one of its first deals, MDC awarded $440,000 in 2002 to create 490 local jobs at a new regional call center. Recipient AccuTel Administrative Services, now called Semperian, is a subsidiary of auto, mortgage and business lender GMAC.25 Although the current credit crunch is hammering Semperian’s parent company,26 this grant recipient has diversified Midland’s energy economy for six years.27

![]()

TRACE Engines received a combined $856,000 in 2006 from MDC and the Texas Enterprise Fund to start a Midland plant to make engines for small planes.28 A strong selling point for the TRACE deal is that aviation diversifies Midland’s economy.29 On the downside, TRACE received substantial public funds from the local and state governments to help create the same 114 jobs. While Trace’s TEF application listed Bethany, Oklahoma as a competitor for the plant, the company’s top investors live in West Texas30 and intended to locate there from the get go. “When we started more than two years ago,” TRACE board member L.D. ‘Buddy’ Sipes told the Odessa American in 2007, “a lot of people saw it as a way to diversify the [local] economy.”31 TRACE sits on the former site of trailer manufacturer TMP, which shut down after meeting the terms of the $50,000 grant it received from MDC in 2003.32

MDC awarded $500,000 to design a nuclear research reactor that the University of Texas System, local governments and defense contractors want to build in neighboring Andrews County. The so-called HT3R reactor would test a thorium-powered, helium-cooled reactor that could generate electricity more efficiently and produce alternative fuels such as hydrogen or liquefied coal. Midland, Odessa and Andrews County officials supplied half of the $3 million needed to draft the “pre-conceptual design” of the proposed $500 million reactor.33 Virginia-based Thorium Power,34 which wants to foster markets for radioactive thorium, kicked in another $1.25 million for the design35 that California-based General Atomics is drafting.36 This MDC-backed experimental reactor could be the next big thing…or it could go the way of the $2 billion Superconducting Super Collider that Congress abandoned to Waxahachie fire ants in the 1990s.

MDC committed another $200,000 to promote a site near Odessa for a $2 billion coal-gasification plant sought by the U.S. Department of Energy (DOE) and the coal and power companies behind the so-called FutureGen Alliance.37 To get the experimental plant, which would capture toxic emissions and global-warming gases, the state offered $21 million cash and $240 million in tax credits. Yet DOE, which was to fund most of the project’s soaring costs, scrapped plans for this plant in January 2008. Instead, the agency said it would fund carbon dioxide removal at several coal gasification plants that power companies now are pursuing independently.38 When Summit Power Group, based in Washington state, announced in 2008 that it intends to build a coal-gasification plant somewhere in Texas, Permian Basin officials said they would try to lure the plant to their backyard.39 Whereas the FutureGen plant sought to sequester 90 percent of its carbon dioxide emissions, Summit plans to build a much larger plant that would sequester no more than 60 percent of its carbon.40

Part of the Permian Basin’s coal-gasification pitch is that it offers a ready market for the carbon dioxide that these plants remove from coal. Area energy companies already buy CO2 to force more oil and gas out of their wells. Recent MDC awards promote local expansions of three companies tied to this CO2 business. MDC proposed giving Natural Gas Services Group, Inc. (NGSG) $275,000 to expand in early 2008. NGSG makes gas compressors used to boost well production. The agency drafted plans in 2007 to pay Odessa-based CO2 processor Reliant Holdings $250,000 to expand. That year MDC also approved a $225,000 grant for the expansion of BCCK Engineering, which specializes in removing CO2, oxygen, helium and nitrogen from natural gas. BCCK invested the funds in a plant that makes nitrogen-removal equipment.41

Several MDC awards could position Midland to capitalize on a potentially huge emerging market for CO2 removal and sequestration. Hatley, who started with MDC in early 2007, said the agency has no strategic plans to get in front of such a trend. Instead, he said that these investments reflect the reality on the ground. The agency must work to retain high-paying energy jobs, Hatley said. “We can’t not put an effort out to dance with the ones that brung us,” he said. In another such dance, MDC awarded $250,000 in 2007 to Kansas-based oilfield services company Sentry International. Hatley said the Midland City Council is weighing an MDC proposal to help fund a manufacturing facility that Fiber Composite Co. wants to build outside city limits. The Big Spring-based company makes fiberglass rods used in oil production. The public funds that MDC invests in this sector clearly run counter to the agency’s economic-diversification goal.

In late 2004 MDC invested in another branch of the energy industry, awarding $210,000 to electricity retailer W Power and Light. Midland-based Amen Properties, Inc. had formed W Power that same year to capitalize on the deregulation of Texas electricity markets. W Power defaulted on the deal after MDC made an initial $70,000 payment.42

In 2001 Midland’s conservative voters approved a sales tax for economic development that they had defeated twice before. This policy reversal—among voters leery of government economic planning—appears to have been an attempt to escape the region’s historic dependence on whipsawing fossil-fuel prices. Despite the expenditure of millions of tax dollars over seven years, Midland continues to be fused to the hip of its traditional energy industry. Its diversification goal notwithstanding, during the current oil boom MDC is awarding increasing amounts of public funds to the oil and gas industry.

A review of MDC’s top-dollar projects suggests that the agency lacks enough good development ideas to wisely invest more than $5 million in annual tax revenue. Too many dollars chasing too few good ideas may have inspired the “new business model” that MDC pioneered with Countrywide. Under that model, MDC offers more public funds with fewer strings attached. The agency also seems to dedicate ever more tax funds to bigger and riskier deals. In this way it keeps up with its income stream and need not return public funds. Yet Entrada, Countrywide and Dean Baldwin stand out as some of the agency’s most reckless schemes. Asked why the agency’s biggest deals have been challenging at best, Hatley said larger capital investments attract more critics. Yet he also added, “I think our best years are still ahead of us.”

One yardstick by which to judge the MDC might be to ask the question: Would a conservative Midland investor embrace such deals as Entrada, Countywide and Dean Baldwin? The answer may turn on how much of his or her own money was at stake.

Endnotes:

1 “Countrywide provides big news for city,” Midland Reporter-Telegram, October 10, 2006. “MDC and Countrywide solidify relationship,” Midland Reporter-Telegram, October 10, 2006.

2 “MDC hits homer with Countrywide,” Midland Reporter-Telegram, October 9, 2006.

3 “Officials say Countrywide cutbacks should not impact Midland agreement,” Midland Reporter-Telegram, August 21, 2007.

4 “Countrywide closing Midland office,” Midland Reporter-Telegram, September 13, 2007.

5 Drillers on University of Texas land first struck oil in the Midland-area in 1923. The largest oil discovery in the continental U.S., the so-called Permian Basin, produced 25 percent of the world’s oil during W.W. II.

6 “The Great Texas Banking Crash,” Joseph Grant, University of Texas Press, 1996.

7 FNBM offered depositors some of the nation’s highest interest rates, with Merrill Lynch pumping $248 million of FDIC-guaranteed deposits into this hemorrhaging bank. Midland millionaires also held pep rallies urging locals to pump money into the ailing bank. Yet it’s unlikely that many millionaires risked more the $100,000 limit insured by the FDIC. See “Burying Mother,” Time Magazine, October 24, 1983.

8 “U.S. helps Texans survive death of bank,” New York Times, October 14, 1984. Of course, FNBM’s failure was just the beginning. Between 1980 and 1994, 599 Texas banks, accounting for 44 percent of the state’s bank assets, failed. By 1988 the Republic Bank of Dallas, which had bought up everything of value at FNBM, had failed, as had its successor: InterFirst Corp. It cost the FDIC more than $3 billion to clean up that mess, which was then the largest bank failure in U.S. history. See The Handbook of Texas Online at http://www.tshaonline.org/handbook/online/articles/RR/cor1.html.

9 “Election story,” Midland Reporter-Telegram, November 7, 2001.

10 “Schumpeter comes to Bush country,” Forbes, October, 8, 2001.

11 See “State Development Fund Rewards Hype,” Watch Your Assets, December 18, 2008.

12 This fund awarded $850,000 to Odessa defense contractor Falcon International and $3.5 million to try to lure the $2 billion FutureGen coal-gasification plant to sites near Odessa or east of Waco.

13 “Lowest Texas unemployment rate: Midland,” CBS 7 News, March 7, 2008.

14 “Texas’ richest is one of smallest,” Dallas Morning News, April 25, 2008.

15 MDC also awarded less than $150,000 each to two oilfield companies (Submersible Oil Pumping Services and NovaStar), two trailer companies (TMP Co’s and Big Tex Trailer Man), the Midland-Odessa Transportation Alliance, uniform supplier Cintas Corp. and UT’s Permanent University Fund.

16 “MDC and Countrywide solidify relationship,” Midland Reporter-Telegram, October 10, 2006.

17 When the building was finished, the Midland Reporter-Telegram reported that MDC spent $1.3 million on construction, $685,000 for utilities and $383,185 on landscaping and signage (“MDC’s Building A raises business profile,” Midland Reporter-Telegram, July 25, 2005). MDC, which reportedly spent $520,000 for the 25 acres of surrounding land ($20,800 per acre), is seeking to sell a bit more than 8 acres with the building. This suggests that MDC spent more than $2.5 million on property that it has been unable to sell for $1.75 million. Earlier Reporter-Telegram reports projected the project’s costs as $2.9 million (see “MDC finds cost on industrial park should be lower than originally projected,” January 31, 2005; “MDC starts work on building to entice new company to Midland,” March 19, 2005). These numbers do not take into account Midland’s lost “opportunity costs,” or what the community might have gained had it invested this money elsewhere.

18 “MDC plans brightened by new industrial land,” Midland Reporter-Telegram, July 1, 2006. The agency has held this land in an undeveloped state, MDC development specialist Mike Hatley said in an interview.

19 www.jessicaswell.com

20 “If we build it, will they come?” Texas Observer, July 27, 2007.

21 “MDC approves lease agreement with aviation company, Midland Reporter-Telegram, April 8, 2008.

22 “ICE arrests 15 aliens in Roswell working for U.S. military contractor,” U.S. Customs and Enforcement, August 29, 2006. www.ice.gov/pi/news/newsreleases/articles/060829roswell.htm. A company executive pleaded guilty in May to knowingly accepting fake identification from illegal immigrants. “Roswell businessman accepts plea deal,” Las Cruces Sun-News, May 23, 2008.

23 “Council rejects MDC proposal with aviation company,” Midland Reporter-Telegram, April 16, 2008.

24 According to online business-information publisher Hoovers.com.

25 GM sold a 51 percent stake in GMAC to Cerberus Capital Management in 2006. See “GMAC’s bank unit has a problem, Wall Street Journal, April 10, 2008.

26 Semperian closed an Oregon office in 2008. “General Motors subsidiary in Eugene closing,” Portland Business Journal, February 29, 2008. “GMAC feels the drag from its struggling mortgage unit,” Wall Street Journal, April 30, 2008. “ResCap’s needs jump to $2 billion,” Wall Street Journal, June 4, 2008.

27 GMAC’s underlying business tends to boom in periods of strong national growth, which can be fed by the kinds of weak oil prices that slow Midland’s economy. See “Lenders ease the throttle on car loans,” Wall Street Journal, April 2, 2008.

28 TRACE received $400,000 from Midland Development Corp. and $456,000 from Texas Enterprise Fund.

29 Although demand for TRACE’s fuel-efficient engines rises with fuel costs.

30“Airplane engine firm to hire 114,” Midland Reporter-Telegram, August 23, 2006.

31 “Revving up the economy,” Odessa American, April 23, 2007.

32 “TMP grant terms met before sale to TRACE,” Midland Reporter-Telegram, September 1, 2006.

33 “UT regents give thumbs up to nuclear reactor,” Odessa American, February 10, 2006. “Andrews reactor opens new possibilities for nuclear power,” Midland Reporter-Telegram, August 20, 2007.

34 Thorium-powered reactors produce less material that can be used to make bombs. Thorium Power, Inc. mines the radioactive metal of the same name but has encountered little demand for this product.

35 Citing an exemption in the Texas Public Information Act, UT officials declined to identify the private donors who contributed the remaining $2.75 million raised for the reactor design.

36General Atomics: Mines Texas uranium through its Rio Grande Resources Corp.; Received $4 million from Texas’ Emerging Technology Fund to develop algae-based fuels in Pecos; and Sells unmanned Predator drones for military and border-patrol uses. Midland’s Trace Engines cites Predators as a possible market for its product.

37 “2006-2007 Annual Report,” Midland Development Corp.

38 “Texas back in game for clean coal,” Dallas Morning News, January 31, 2008.

39 “Officials say they hope FutureGen efforts not wasted,” Midland Reporter-Telegram, April 16, 2008.

40 “The coal plant ex-Mayor Miller does support,” Houston Chronicle blog, March 28, 2008.

41 “BCCK Engineering ready to show off fabrication facility,” Midland Reporter-Telegram, January 27, 2008.

42 “MDC cancels W Power deal, boosts engineering company,” Midland Reporter-Telegram, June 30, 2007. MDC repaid half of the $70,000 it received from MDC.

Entrada Building A: For Sale By MDC Commercial Realty

Entrada Building A: For Sale By MDC Commercial Realty Nadine and Tom Craddick watch then-Governor George Bush designate La Entrada al Pacίfico an official state Trade Corridor in 1997. President Bush later designated it a federal “high priority corridor.”

Nadine and Tom Craddick watch then-Governor George Bush designate La Entrada al Pacίfico an official state Trade Corridor in 1997. President Bush later designated it a federal “high priority corridor.”